Tax administration in Nigeria 2: Filing & Assessment

Filing annual returns ensures that a business complies with the requirement of the tax laws. It also ensures that a company gets Tax Clearance Certificate (TCC) which is a requirement for government contract bidding in Nigeria. Failure to file annual returns with the FIRS attracts penalties that can become a major problem to a business.

For a business to file with FIRS, it must prepare its returns and assess itself based on returns filed, this is called self-assessment. The process of self-assessment involves a taxpayer preparing its financial statements or statement of affairs, and tax computation as the case may be.

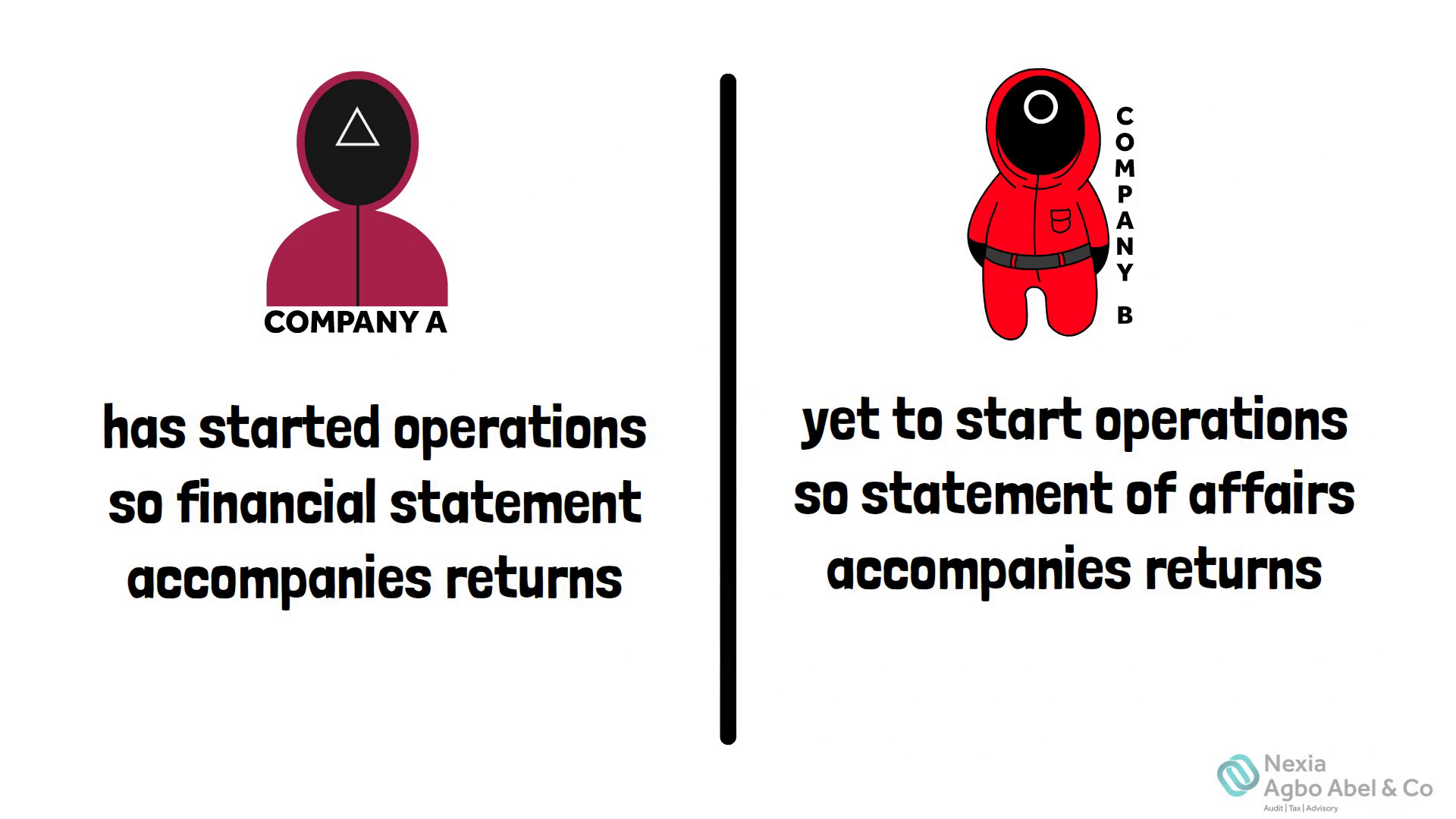

The financial statements accompany the returns for companies that have started operations, and statement of affairs accompanies the returns of the companies that are yet to commence operations.

Once the company has prepared its returns, if the returns include financial statements (that means the company has commenced operation), it then assesses itself by preparing a tax computation based on the operating results in the financial statements for the year.

On the other hand, if the return is a Statement of Affairs, the company does not need to prepare tax computation. This is because there is no profit to tax as the business is yet to commence operation.

In whatever case, the company goes on TAXPROMAX (which is an online platform for filing returns with the FIRS), files and then generates a DIN which is a numeric code used to pay any due taxes arising from the filing.

The whole process of filing returns for each financial year, must be done within 6 months after the end of the relevant accounting year. Failure to meet up with this timeline attracts penalties due to late filing.

The process of assessment does not stop there, as FIRS might subject the company returns to a desk review or examination to ensure that returns have been properly filed in accordance with the relevant tax laws. If they have any objection, they might require the company to provide further information/documents in support of the filing. A notice of additional assessment might be raised where the FIRS is not satisfied with the response of the company. The company is required to respond within 30 days of receiving the notice. Failure to respond within this period will make the assessment of the FIRS binding and final.

The next phases in the process of Tax Administration are Collection & Enforcement and Objection & Appeal, which will be discussed in two separate episodes.